Gluten Feed Market to Hit USD 2.2 Billion by 2035, Driven by Rising Demand for Cost-Effective Livestock Nutrition

The gluten feed market is projected to grow to USD 2.2 billion by 2035, driven by its cost-effective, nutrient-rich, and sustainable solutions.

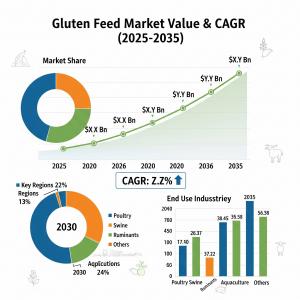

NEWARK, DE, UNITED STATES, August 20, 2025 /EINPresswire.com/ -- A new market analysis report reveals the global gluten feed market is projected to grow from an estimated USD 1.3 billion in 2025 to USD 2.2 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.5%.

The report highlights a compelling growth outlook, driven by increasing utilization of gluten feed as a cost-effective and nutrient-rich component in livestock feed formulations, particularly for ruminants. This steady expansion presents a clear solution for manufacturers facing rising input costs and evolving consumer demands for sustainable practices.

The gluten feed segment, while currently representing a 0.7% share of the overall animal feed market, is gaining significant relevance as a strategic and economical protein source. Derived primarily from corn wet-milling and wheat processing, its ability to provide high energy and digestible fiber at a competitive price point is a critical advantage for livestock producers seeking to optimize their formulations without compromising animal health.

For manufacturers, the market's growth is a direct response to a primary challenge: feed cost optimization. In a volatile commodity market, gluten feed offers a stable and proven alternative that supports both performance and profitability. This is particularly true for beef and dairy cattle diets, where its inclusion has demonstrated improved feed conversion efficiency, reducing reliance on expensive traditional grains.

The report also underscores the powerful role of corn-based gluten feed, which is expected to dominate the market with a 64.3% revenue share in 2025. This dominance is not accidental; it is a direct result of the abundant global supply of corn and a well-established wet-milling infrastructure.

For manufacturers, this means a consistent, reliable supply chain for a high-quality ingredient with a balanced nutrient profile. The co-production of corn gluten feed alongside ethanol and corn oil has further enhanced cost efficiencies, ensuring that this solution remains economically viable for large-scale operations.

The demand for cost-effective solutions is particularly pronounced in emerging markets. The report highlights impressive regional growth, with China leading at a 7.4% CAGR and India at 6.9%. These regions are experiencing rapid industrial feed manufacturing expansion and a growing need for accessible feed resources.

Manufacturers can capitalize on these opportunities by focusing on enhanced distribution networks and establishing strategic partnerships with bioethanol processors. This localized approach mitigates procurement risks and reduces transportation costs, directly addressing key logistical challenges for manufacturers in these high-growth areas.

From a form-factor perspective, dry gluten feed is the dominant segment, projected to hold a 59.2% market share in 2025. This trend offers manufacturers significant logistical and operational benefits. The longer shelf life and ease of bulk transportation without spoilage make dry gluten feed an ideal component for automated feed distribution systems and integrated livestock farms. Its lower moisture content ensures better stability and energy concentration per unit, positioning it as an operationally efficient choice for high-volume feeding programs and long-distance transport.

The poultry sector is identified as the most significant livestock category, poised to account for 61.5% of total market revenue by 2025. As global poultry meat and egg production scales, the need for consistent and affordable protein-rich feed inputs intensifies. Manufacturers can strategically position gluten feed as a solution to this demand, leveraging its digestibility, energy density, and cost-effectiveness to improve feed conversion ratios for broiler and layer formulations.

Request Gluten Feed Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-22977

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

The competitive landscape is defined by key players like Cargill Incorporated, Archer Daniels Midland Company (ADM), and Roquette Frères. These industry leaders are not merely reacting to market trends; they are actively shaping the future through strategic initiatives. Their focus on vertically integrated operations, product formulation improvements, and regional logistics hubs provides a blueprint for manufacturers to follow. By prioritizing supply chain efficiency and investing in advanced blending technologies, companies can ensure a consistent and high-quality product that meets the evolving needs of their customers.

As the industry moves towards greater sustainability and a circular economy, the utilization of gluten feed—an agricultural byproduct—reinforces a resource-efficient model. This aligns with modern business objectives and growing consumer awareness, making it a powerful narrative for manufacturers. By embracing gluten feed, manufacturers can not only optimize their costs but also contribute to a more sustainable and resilient feed industry.

Explore Related Insights

Feed Carbohydrase Market: https://www.futuremarketinsights.com/reports/feed-carbohydrase-market

Feed Enzymes Market: https://www.futuremarketinsights.com/reports/feed-enzymes-market

Feed Premix Market: https://www.futuremarketinsights.com/reports/feed-premix-market

Editor’s Note:

The market values and growth rates in this press release are sourced from the provided content. For a detailed breakdown of regional insights and key player strategies, refer to the full report.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.