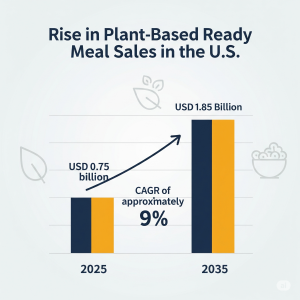

US Plant-Based Ready Meals Market to Reach USD 1.85 Billion by 2035, Growing at 9% CAGR | FMI

US plant-based ready meal sales set for strong growth, creating opportunities for manufacturers to innovate and expand across regions and consumer segments.

NEWARK, DE, UNITED STATES, August 11, 2025 /EINPresswire.com/ -- A new market analysis reveals the U.S. plant-based ready meals sector is on a robust growth trajectory, with sales expected to more than double from an estimated USD 0.75 billion in 2025 to USD 1.85 billion by 2035. This significant expansion, underpinned by a Compound Annual Growth Rate (CAGR) of 9.0%, signals a major opportunity for manufacturers to innovate, streamline operations, and capture a rapidly expanding consumer base.

The report highlights that success will hinge on a solution-focused approach, addressing key challenges in distribution, pricing, and product development to support future growth.

The demand is being driven by a confluence of factors, including shifting dietary preferences, increased awareness of sustainability, and a growing need for convenient, healthy food options. For manufacturers, this presents a clear mandate to align their strategies with these trends. The market is not a monolith; it is segmented across various product formats, distribution channels, protein sources, and consumer profiles, each presenting unique entry points and opportunities for specialized product lines.

The frozen entrée segment, for example, is the undisputed leader, projected to hold a 68% market share in 2025. This dominance is attributed to strong shelf presence, extended storage life, and established consumer familiarity. For manufacturers, this is a strategic sweet spot. Expanding product lines within this category—such as comfort-style pastas, bowls, and stir-fries using proven protein sources like soy and pea—can leverage existing retail freezer infrastructure and consumer purchasing habits. Gardein (Conagra Brands) exemplifies this by launching a comfort-focused frozen entrée line, including the Ultimate Plant-Based Fried Chick’n Mac & Cheeze Bowl, directly competing with conventional ready meals.

However, growth is not limited to the freezer aisle. The analysis identifies strong momentum in other formats. Chilled microwaveable meals are gaining ground among urban professionals and small households, reflecting a demand for grab-and-go convenience. Shelf-stable bowls and pouches, with a projected 9% annual growth rate, are proving effective for e-commerce and meal kits due to their low distribution costs and pantry-friendly nature. This diversification allows manufacturers to target different consumer lifestyles and shopping behaviors, from the weekly supermarket trip to a quick grab at a convenience store.

The distribution landscape is also evolving. Supermarkets will remain the dominant channel, accounting for 54% of sales in 2025. However, the fastest growth is seen in online grocery and direct-to-consumer platforms, which are forecast to grow at over 17% CAGR. This signals that a robust omnichannel strategy is no longer optional. Manufacturers must not only secure shelf space in mainstream chains like Kroger and Whole Foods but also invest in digital partnerships and direct-to-consumer models to reach eco-conscious millennials and Gen-Z snackers who rely on online shopping and subscription services.

Price remains a key lever for market expansion. While the average price premium over meat-based ready meals has dropped to 13% in 2025, continued efforts to achieve price parity will unlock significant demand from mid-income households. The analysis suggests that improvements in manufacturing scale and the proliferation of private label offerings—such as Kroger’s Simple Truth and Target’s Good & Gather—are critical for accelerating affordability and access.

These private-label programs, which offer products at 10-15% below branded equivalents, are putting pressure on smaller suppliers but also helping to mainstream the category. This makes a strong argument for manufacturers to either scale up operations or specialize in niche, premium products that command higher margins and consumer loyalty.

Regional insights further underscore the importance of tailored strategies. The analysis highlights a shift in growth dynamics, with high-growth Sun Belt cities like Houston and Phoenix projected to register the fastest CAGR of 2.54% between 2025 and 2035. This acceleration is driven by strong population inflows and rapid per capita adoption, which is narrowing the gap with traditional coastal hubs.

Manufacturers looking to capture this growth must adapt their distribution and marketing to these markets, which are expanding their retail assortments faster, especially in mass retailers and club stores. In contrast, mature markets like New York City, which already have a high per capita consumption, will see more steady growth driven by repeat purchasing and the introduction of new formats, particularly in the chilled and ethnic product segments.

The competitive landscape is a mix of established players and agile newcomers. Amy’s Kitchen, a long-standing vegetarian brand, has deep penetration in natural-channel supermarkets. Sweet Earth Foods (Nestlé USA) leverages a massive distribution network to place products in mainstream supermarkets, while Gardein (Conagra Brands) benefits from significant scale synergies within a USD 12 billion frozen-foods portfolio. The recent liquidation of Tattooed Chef and the acquisition of Alpha Foods by LiveKindly Collective highlight that manufacturing scale and a comprehensive omnichannel reach are becoming critical for survival and success.

Request Sales of Plant‑based Ready Meals in US Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-22889

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

In conclusion, the U.S. plant-based ready meals market presents a compelling narrative of growth and opportunity. For manufacturers, the path forward is clear: address the demand for convenience with diverse product formats, optimize distribution across physical and digital channels, and strategically manage pricing to appeal to a broader consumer base. By focusing on these solutions, manufacturers can not only navigate the evolving landscape but also play a pivotal role in shaping the future of food.

Explore Related Insights

Frozen Ready Meals Market: https://www.futuremarketinsights.com/reports/frozen-ready-meal-market

UK Frozen Ready Meals Market: https://www.futuremarketinsights.com/reports/united-kingdom-frozen-ready-meals-market

USA Frozen Ready Meals Market: https://www.futuremarketinsights.com/reports/united-states-frozen-ready-meals-market

EDITOR'S NOTE:

This press release is based on a comprehensive market analysis of the US plant-based ready meals sector, providing insights into growth drivers and key market dynamics. All data and figures are sourced from the included market study.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.